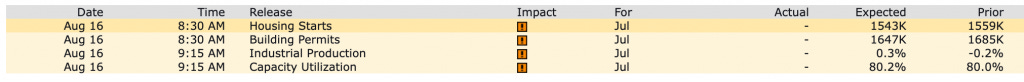

Market Outlook- 16 Aug, 2022

Technical flows and the higher levels of resistance ahead as the pain trade for big money is still the ride upwards. Pullbacks will be buying zones until we break the pain trade upwards.

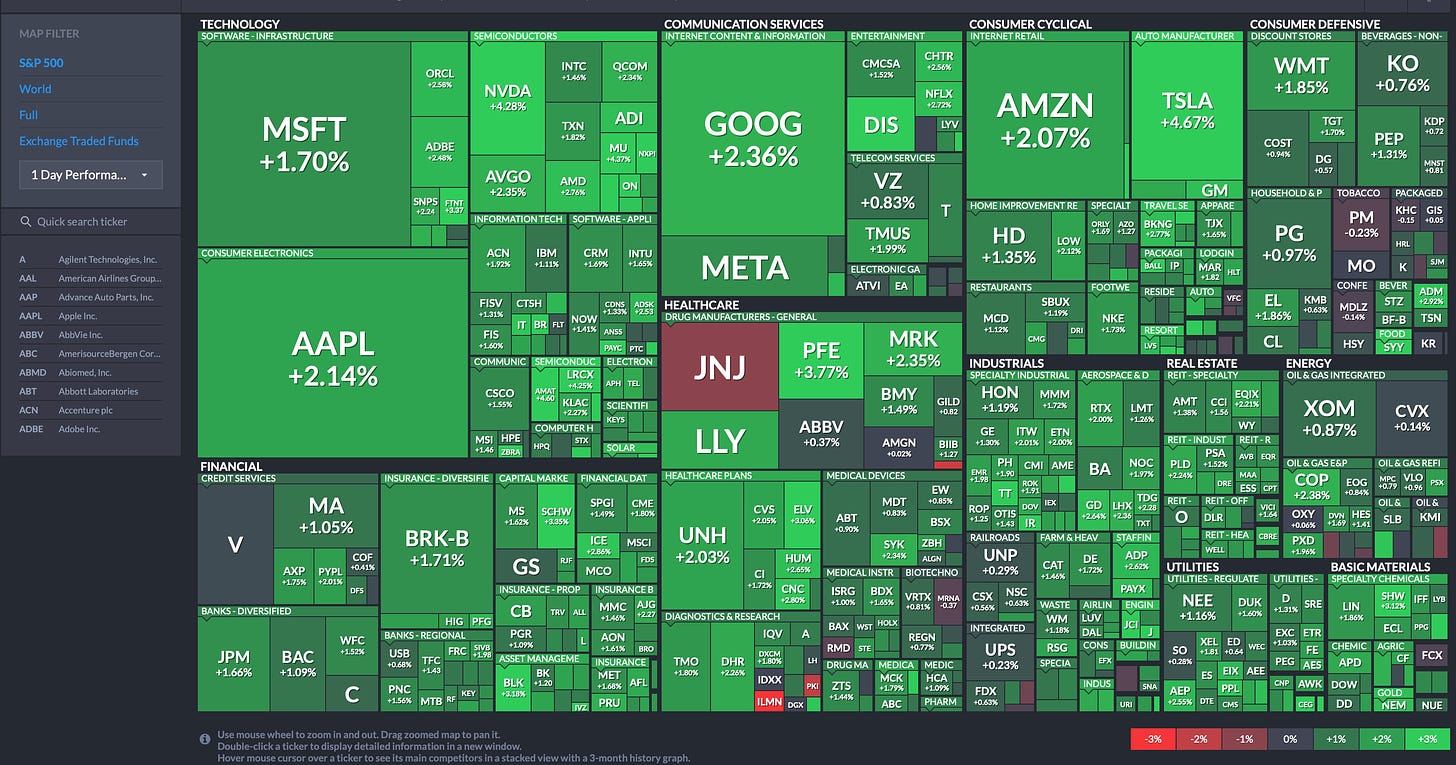

Traders are holding support action after another day of upward pressure across the board. The heat map says it best. There is a drift back to the big tech spaces and energy takes a big hit as China news creates a backdrop of difficulty. Healthcare continues to fade off highs as the new bill seems to add pressure there and interest rate increases also have a significant negative impact in the space as well.

A three-month outlook shows flow - some of these moves are set to experience a bit of mean reversion but we have to wait for the formations to properly set up.

News is light in the OpEx week - and if it is bad, the market is ignoring it, for now.

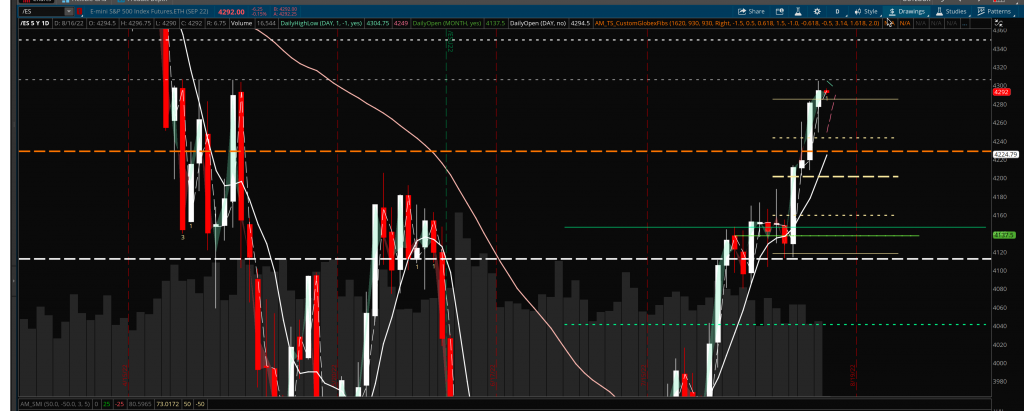

Here are the drawings of interest for the charts - first the ES_F - the lines are the noted zones of congestion and the battle to hold the 50% retrace from last year's high to low is showing as the war zone for key support. Sor far, the buyers remain in control but that line near 4225 in the ES_F will be the Rubicon. Note the current resistance zones to the left

Now for the NQ_F

For the small caps that deserve a look as so many have been talking about the out performance - not sure the chart actually shows that. The orange dashed line just above the candles is only the 25% retrace from the range of last year.

The news has not provided good feedback regarding price action over the last days - this tells me that we are still in a squeeze with 'overbought' signals everywhere. My suspicion with all the short calls and long puts I saw going through the chains into the close is that the reverse will occur today with another run up before we exhaust. There simply are too many people on the short side of the trade now and they continue to get stopped out.

Here's the range I'm trading and then watching for the break. See you in the Teams room!